Introduction

Over the course of the next two days corporate Guyana will come alive with annual general meetings scheduled to be held by two of the country’s public companies. Demerara Tobacco Company Limited (Demtoco), a subsidiary of the British American Tobacco, plc. will have its meeting on March 31 and one day later on April 1, the Guyana Bank of Trade and Industry (GBTI), a 61% subsidiary of Edward B. Beharry and Company Limited, will have its annual general meeting. The Companies Act 1991 allows companies six months to hold their AGMs and the companies are to be commended for their early meetings.

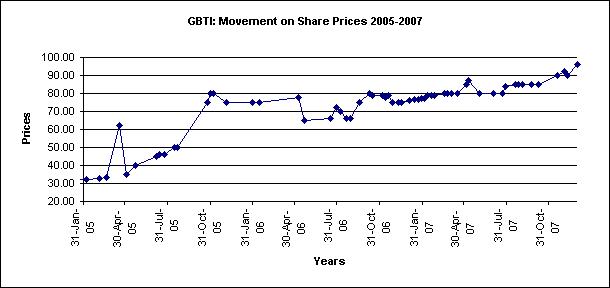

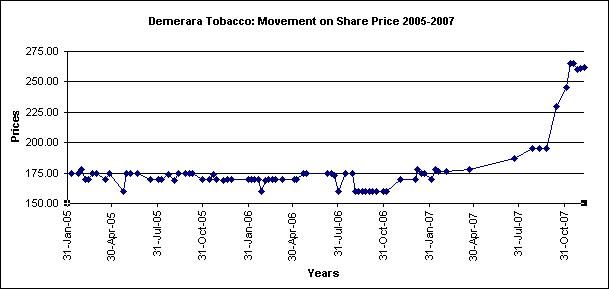

GBTI reports a 57% increase in after tax income for 2007 coming after a 51% increase in 2006 while Demtoco has had more modest increases, 34% in 2007 and 14% in 2006. By any measure these are extremely impressive results which are reflected in the performance of the companies’ share prices over the past three years and provide returns that ironically make bank deposits seem correspondingly unattractive. The average deposit account at the GBTI yielded a return of 3.5% while an investor in the shares of the bank earned 33% (26% of which represents capital appreciation) on his shares.

With inflation close to 15% in 2007, the depositor would have seen the real value of his/her deposit decline by about 12% while the investor’s return, which includes cash income by way of dividends and the increase in the market price for the share, amounts to a healthy 16%.

The lesson is that it is far more attractive to own shares in a reasonably profitable company than to put money in a bank account. The Guyana Stock Exchange (GSE) has not had the desired effect of increasing the number of public companies and with most of Guyana’s public companies being held by controlling shareholders the options for investment in Guyanese companies are limited. But with the removal of exchange controls, the operation of the CARICOM Double Taxation Treaty and the introduction of the CARICOM Single Market and Economy (CSME), there is no reason for limiting the options to Guyana.

It is true that the GSE has outperformed the regional exchanges since its inception in 2003 but much of that is due to what are called market corrections which are unlikely to continue unless all the companies on the Guyana Exchange can match the 2007 performance of Demtoco and GBTI.

Graph of share price movements

Source: The Guyana Association of Securities Companies and Intermediaries Inc., weekly trading reports

Demtoco

Turnover has barely managed to keep abreast with inflation increasing by 16% but the increase in the profit after tax is due to a 30% increase in gross profit – sales less cost of sales – as a result of two price increases in the year which unlike the increases in the price of rice and flour hardly earned a comment in the national press. There is little analysis offered by the Chairman in his one page report or by the Managing Director, neither of whom commented on any impact VAT may have had on the company’s product and performance. The company paid three interim dividends in 2007 amounting to $21.38 per share and is proposing to the shareholders a final dividend of $15.85 making a total of $37.23 giving shareholders a return of 17% on the average market price of the share during the year.

The group gets more however, having charged the company more than $600 million dollars for management services, royalties and technical and advisory services to what it is now no more than a marketing company. The company continues to justify a royalty for a product that can be bought almost anywhere outside of Guyana and seems able to justify exorbitant management services when all the company does is bring in a product sold mainly through at most a handful of distributors.

The balance sheet of the company shows a healthy situation with the company being able to make available to its fellow group companies more than $400 million dollars at the end of the year of which only 60% earns interest at the rate of 4% per annum.

Once again the company does not disclose the number of employees nor does it include anything on corporate governance. Readers will recall one past Country Manager publicly proclaiming defiance to any suggestion that it should comply with Corporate Governance Guidelines until these become legally binding prompting a rejoinder that corporate governance is not a matter of law but best practice (Stabroek News 22/5/04).

Financial Highlights

| 2007 | 2006 |

Change |

||

| G$M | G$M | G$M | % | |

| Gross turnover | 4,574 | 3,933 | 641 | 16 |

| Cost of sales | (1,906) | (1,880) | (26) | 1 |

| Gross profit | 2,668 | 2,053 | 615 | 30 |

| Other operating income | 20 | 18 | 2 | 12 |

| Operating expenses | (920) | (772) | (148) | 19 |

| Profit before taxation | 1,768 | 1,299 | 469 | 36 |

| Taxation | (895) | (648) | (247) | 38 |

| Profit after taxation | 873 | 651 | 222 | 34 |

| Ordinary shares in issue (‘000) | 23,400 | 23,400 | ||

| Earnings per share (in dollars) | 37.29 | 27.82 | ||

| Dividends declared per share | 37.23 | 27.75 | ||

GBTI

The report by GBTI is far more comprehensive than Demtoco’s, running to 86 pages of material and lots of pictures including two Ministers of Government. Unlike Demtoco the Bank produces a full page Statement on Corporate Governance and eye-catching Financial Highlights although the reader has to go through nineteen pages before s/he finds these.

All the indicators are positive in favour of the shareholders if not the depositors in the bank. Shareholders receive a return of 33% in dividends and capital appreciation, while depositors of interest bearing accounts earned 3.5% (3.4% in 2006) and the average of all depositors 2.6% (2.5% in 2006). Share prices during the year increased by 26% on an increase in earnings per share of 57% and if the bank’s outlook for itself and the economy is shared by investors, then it is quite possible that there will be a further movement in share prices over the next few months.

The company reports accumulated provision for loan losses amounting to 96% of its non-performing portfolio, having written off $831 million in 2006 but only $20 million in 2007. From a profit and loss account perspective the provision for loan losses declined by $70 million which has augmented the profits for the year.

Another contributor to the substantial after tax profits of the Bank is the reduced effective rate of tax it pays for the year – at 18% it is half the effective rate paid in 2006 and results from more than $300 million in interest earned being “not taxable”. The normal rate of corporation tax is 45% and if the effective rate had remained at 36%, after tax profits would be $170 million less.

Loans

A bank’s contribution to national development can be measured by its lending to key sectors of the economy. The sectoral analysis of the bank’s loan portfolio shows agriculture accounting for a mere 7.64%, a further reduction from the 9% in 2006. By contrast the share of the portfolio to the services sector has increased from 38% to 43%. Nationally agriculture accounts for approximately 25% of GDP. While the Bank was once considered the rice farmers’ bank (other than GNCB), some operators in the sector lament that the Bank has been taking a very harsh line on borrowers in the rice sector. Indeed this makes it somewhat paradoxical that the Bank won a bid to manage the EU G$1.6 billion facility to increase the efficiency and sustainability of the rice sector.

The loans to deposit ratio has declined slightly from 28% to 26% despite having won the bid and having received $825 million interest free under the Scheme. The Scheme comes to an end in June of this year but the annual report is unclear whether interest will then become payable on the amounts drawn down.

Highlights

| 2007 | 2006 |

Change |

||

| G$M | G$M | G$M | % | |

| Net Income before taxes | 976 | 788 | 188 | 23.86 |

| Net Income after taxes | 796 | 506 | 290 | 57.25 |

| Total assets | 42,981 | 35,742 | 7,238 | 20.25 |

| Total deposits | 37,408 | 31,326 | 6,082 | 19.41 |

| Loans and advances | 9,745 | 8,745 | 1,000 | 11.43 |

| Return on Average Assets % | 2 | 1 | ||

| Return on Average Equity % | 66 | 42 | ||

| Earnings per share $ | 19.89 | 12.65 | ||

In their outlook for 2008 and beyond, the Chairman and the CEO were both upbeat about the prospects for the country, reflected in the extension of their branch network and new Head Office to be constructed during the year. Neither mentioned the events in Lusignan (January 26) or Bartica (February 17) and the consequential threats to the economy. It would be interesting to see which one of our two companies would be impacted more directly if the country does not solve events of that nature.

Finally, the results for both entities show how the tax system can be worked in favour of corporate taxpayers with the range of “tax shelters” that are available. Individuals, bound by a single personal allowance and a tax rate of 33⅓ %, can only read with envy.