Introduction

In today’s Business Page I conclude the discussion started last week on the announcement by Dr Roger Luncheon that the government has sold the country’s 20% shareholding in the telecommunication company Guyana Telephone and Telegraph Company Limited (GT&T) to an unknown Chinese entity. The announcement came a few days after the 2012 Budget Speech which contained no mention of the sale negotiated by NICIL of which the Finance Minister is the Chairman.

Well we now know that the Chinese company is Datang, less known for its connection with the Chinese Liberation Army than for its development, production and sale of electronic information systems and equipment. Incredibly the company appears to have not had a formal meeting with the 80% shareholder, Atlantic Tele-Network of the USA and it will certainly be interesting to learn how the usually sceptical US Government will view a partnership of their company with the Chinese who do not have a good record as a respecter of intellectual property or confidentiality of information.

Under the Companies Act 1991, the ownership of the shares in the company will pass to Datang on the delivery to them of the transfer form and the share certificate. At that point, except that the government is the government, it would cease to have any interest in GT&T. Interestingly, at that point, the Government of Guyana’s rights under the 1991 agreement with ATN in relation to any share-ownership right shall cease. Datang will no doubt soon present itself to the GT&T management with the share certificate and transfer form in their hand for what will no doubt be a very useful exchange.

Last week we were told that the government is selling its interest for US$30 million of which US$25 million is to be paid immediately and the balance paid later. Meanwhile in a couple of weeks Datang will participate in an AGM at which dividends will be on the agenda. Unfortunately Mr Winston Brassington seems to have negotiated an agreement under which dividends that ought to come to the government will go to Datang! How eerily does history have a way of repeating itself! A not too dissimilar situation arose when the PNC administration sold Guyana Telecommunications Corporation with a bundle of cash in the bank. I wonder what those who then accused the PNC of being either careless or stupid would think of the Privatisation Board and the Cabinet for giving away US$2 million.

But that is not the only give-away. At US$30 million, the price for the shares is a significant markdown on what the shares are worth. GT&T is not a public company and its shares are not traded anywhere for their value to be determined. There are then two options. The first is to take all relevant factors into account, project the income of the company into the future and discount these into present day value. The alternative is to take a price earnings ratio (a vital tool used by investors) of the shares in a similar entity and, making adjustment for specific factors, apply a P/E ratio to the earnings of the company. Using that method I have arrived at a price of approximately US$40 million.

So we – or rather Drs Luncheon and Singh and other ministers along with Brassington have given away some US$12 million of the taxpayers’ money. They did the same when they waived some G$400 million of interest and preference dividend in the Berbice Bridge Company Inc so that the private sector entities could receive theirs.

The question why these gentlemen would have acted so recklessly and secretively probably has to do with the diversion of public funds from the Consolidated Fund to the illegally operating NICIL, all the directors on the Board of which are Cabinet members. That is unheard of anywhere in any self-respecting country, but is easily explainable as the creation of an illegal fund from which Cabinet can do as it pleases: pay over price for goods and services, divert, build white elephants, etc – all in complete violation of Articles 216 and 217 of the constitution. And to add some veneer of legality and acceptability to the saga, Dr Singh the Finance Minister, had the decision passed through the Privatisation Board of which Dr Singh is the Chairman!

These bright gentlemen have decided to bypass the constitution and do through the backdoor what they are not allowed to do through the front door.

On the Line: 2011 Annual Report of New Building Society

The editor reminded me that it is that time of the year when annual reports for companies and entities with a December 31 year end become available. Starting today with the 2011 Annual Report of the New Building Society (NBS) Business Page will review those reports well aware that other national economic issues will not wait. The page will try to offer a balance between the two.

The annual general meeting (AGM) of the NBS is slated for Saturday April 28 and will be held in the Society’s new head office in North Road, to which the Society moved a few weeks ago. It is to the credit of the institution that the move appears to have gone off quite smoothly, at least so far as the customers were concerned.

Readers will recall that the Society was brought under the Financial Institutions Act in August 2010 and the results for 2011 would have been the first full year since the new status. Surprisingly, however, there was only a passing reference to the impact of this is in the Chairman’s report: “It is also to be noted that notwithstanding the Society is currently governed under the New Building Society’s Act, Chapter 36:21, the Supervision by the Bank of Guyana, must be seen as a positive sign.” I am sure members would have liked to know the full impact, if any, the FIA has had on the Society in the absence of which the directors should have indicated whether they intend to take the full four years to come into full compliance with the provisions of the Financial Institutions Act.

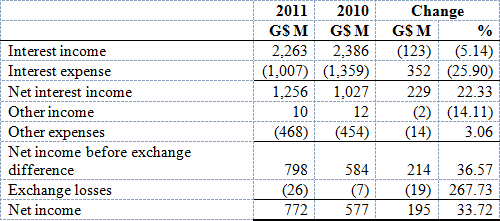

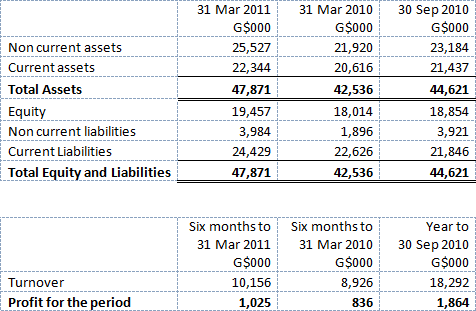

Source: 2011 audited financial statements

As the table above shows interest income from mortgages and other assets fell by 5% but interest paid on deposits declined by a dramatic 26% with the result that the net interest income increased by $229 million. Loss on exchange has again raised its ugly head after the directors resiled from a members’ decision to repatriate the moneys held in the UK and as a consequence the Society lost some $26 million following a $7 million loss in 2010.

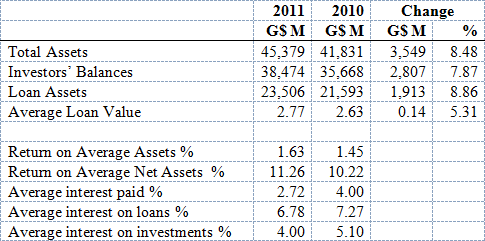

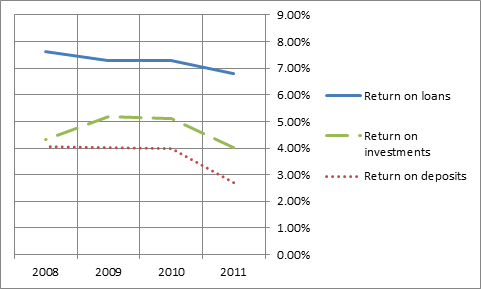

Dr Nanda Gopaul, who has signalled his intent not to continue as Chairman of the Society following his appointment as a minister of the government, in his report announced a “record profit of $772M being made, an increase of 34% over the previous year.” According to Dr Gopaul this “was achieved despite reducing our mortgage rates for lower, middle and higher income mortgagors at the beginning of the year from 4.75%, 6.95% and 7.95% to 4.25%, 6.25% and 7.45% respectively.” That was only half the truth since the reduction in interest income was only $123 million. The real reason is obvious from the graph below that shows that while the returns on loans have declined from 7.3% in 2009 to 6.7% in 2011, the average interest paid to depositors declined dramatically from 4% to 2.7%!

It would have been helpful if either the Chairman or the CEO gave an explanation for the significant reduction in the Society’s deposit rates rather than have members speculate on whether the Society is carried away by the misnomer “profits” rather than surplus, or is seeking to discourage persons putting money into the Society which it is then unable to on-lend.

Returns on Loans, investments and deposits

Source: 2008 to 2011 audited financial statements

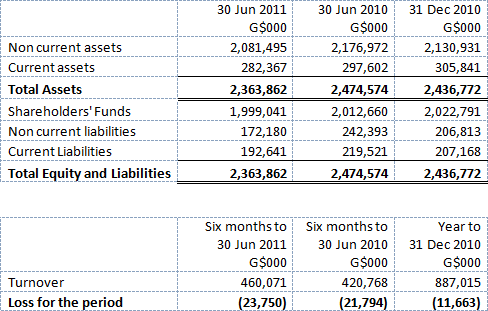

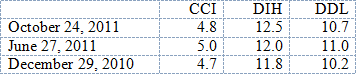

Source: 2010 and 2011 audited financial statements

The Society has increased its loan limit to $15 million subject to ministerial approval, which it says the Society is working towards making a reality, so that its financial resources can be more beneficially utilised to the advantage of members and customers.

In 2011, there was a net increase in the number of mortgage accounts of 276 while the Society disbursed mortgage advances for the year totalling $4.2B, another record, which was 43% higher than the previous year. At year end, the mortgage portfolio was 52% of Assets or 61% of Total Investors’ balances.

The Society continues to record its satisfaction in its investment in the Berbice Bridge Company Inc, which earned the Society a healthy return during the year and some 32% cumulatively. The Berbice Bridge commuters’ pain is the NBS’s members gain. While the financial logic of the decision to make the investment cannot be faulted, the amendment to the Act permitting the investment and the financial structure of the bridge transaction by the Jagdeo-Brassington team is one costly venture for the country’s taxpayers who have had to finance substantial tax concessions benefiting the bridge investors.

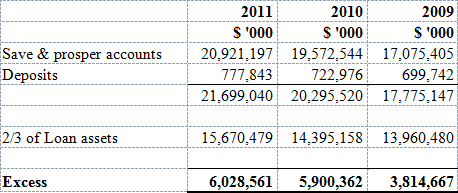

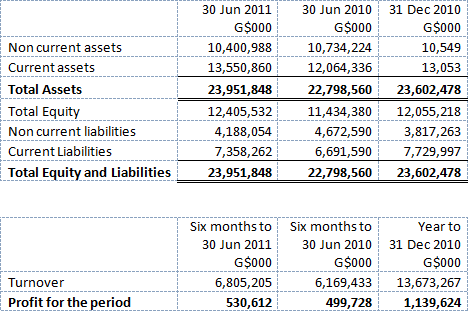

Source: 2009 to 2011 audited financial statements

Two years ago, Business Page highlighted the breach of the proviso to section 7 (d) of the New Building Society Act. Despite this, the situation has deteriorated and the shortfall in mortgage assets has increased by 58%.

Next week, I will review the annual report of Demerara Distillers Limited, whose annual general meeting will be held on April 27, 2012.