Introduction

Today we continue our review of the annual reports of two more of the country’s public companies – Caribbean Container Incorporated (CCI) which held its annual general meeting last Friday and the Guyana Stockfeeds Incorporated (Stockfeeds) whose annual general meeting is scheduled for tomorrow. Both these companies are on the Secondary List of the Guyana Association of Securities Companies Incorporated (GASCI), popularly referred to as the Guyana Stock Exchange.

As a result of a challenge in the High Court of Guyana by the government company National Industrial and Commercial Investment Limited (NICIL), a shareholder of the company, the company is not permitted to issue any new shares until the outcome of this matter is fully settled. The regulator, GASCI has suspended trading of the company’s shares until the matter is settled. The shares of neither company, both of which have a dominant shareholder, are actively traded on GASCI with the last trade in the shares of CCI taking place on January 9 of this year while for Stockfeeds there has been no trade since October 27, 2008.

In the case of CCI, the dominant shareholder is a non-public company which goes by the name of Demerara Holdings Inc, which has some 129 million of the 152 million of the issued shares of the company, while in the case of Stockfeeds, Chairman and CEO Robert Badal owns some 35 million while an associate of his owns 25 million of the issued shares. Except for DDL and Banks DIH, the majority interest in all our public companies are held by a single shareholder with the minority shareholders playing a passive role. This raises the issue of the prospects of the survival of our public companies as they are supposed to operate.

CCI

CCI has had a checkered history with ownership changing hands from government to Ansa McAl to Rand Whitney and now Demerara Holdings Inc, which it is believed is in turn owned by CCI’s Executive Chairman Ronald Webster, who has been with the company for decades. In an era when recycling is becoming the buzzword, it is good to see CCI making some strides to sustainability. Its non-executive directors include Dr Elisabeth Ramlal and Mr Frank DeAbreu, one of Guyana’s younger breed of entrepreneurs.

Shares transactions

Shareholders were called upon to ratify the passing of two resolutions which had already received the blessing of the majority shareholder: one dealing with the cancellation of shares and the other with the issue of bonus shares. The first is to cancel 1,500,000 ordinary shares standing in the company’s name resulting from the reacquisition of the said shares. In 1992, these shares were allotted under an Employee Share Purchase Plan and were fully paid for on behalf of the employees via a loan from a financial institution. However, at the time of winding up the said plan, none of the shares allotted were taken up by the intended employees, nor had they settled the outstanding repayments in relation to those shares.

In keeping with the requirements of the Companies Act the directors of the company have decided to cancel these shares and treat them as part of the authorised but unissued shares. According to the company, the transaction should have no effect on the company’s equity but where I have some difficulty is the statement that the Revenue Reserve Account is credited and I doubt that shareholders would have been clearer.

The second resolution is to authorise the issue of 1 bonus share for every 50 shares owned. Bonus shares are not paid for and at one time were very popular in Guyana, particularly with Banks DIH. They have fallen into disuse because they are a kind of artificial transaction with a mere book entry between equity accounts without any increase in the company’s asset value or earnings prospects. Accordingly, if there is one bonus share for every one share in issue, the price per share is halved. However, when the capital market was even less developed than now, the share price never moved, and the ‘bonus” turned out to be a real bonus. Maybe with a bonus issue of one share for every fifty held, there is not going to be much change in the market price.

Financial Summary

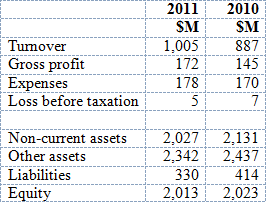

Source: Audited financial statements 2011

In 2011, turnover increased by 13.4% from $887 million to just over one billion dollars and earnings before depreciation (EBDA) by 3.3% from $115 million to $119 million. Gross profit at $172 million was up by 19% over 2010’s GP of $145 million. The loss before tax was reduced by 25% from $7 million to $5 million. Without any real discussion, the Chairman attributed the year’s improved performance to good sales and production efficiencies. Gross profit on sales remained constant at 30% and while finance charges fell by $7 million, administrative expenses rose by $14 million, mainly in staff costs.

The company has some $66 million in retained earnings out of which dividends could be paid and may have caused one shareholder to complain to me that as a group they have been receiving nothing by way of dividends from the company. The company also has $43 million in the bank and there must be some reason for the ultra-conservative decision not to pay any dividend. Maybe there is a belief that a bonus of one share for every fifty held will appease the shareholders.

Guyana Stockfeeds Incorporated

The company manufactures and distributes livestock feeds and related products including day-old broiler chicks to both the local and export markets. It also produces parboiled rice for the export market under its “Angel” brand. In the domestic market feed sales grew by 30% while baby chick sales grew by 5% but in the face of competition from Brazilian suppliers of parboiled rice, rice export sales declined by 16%.

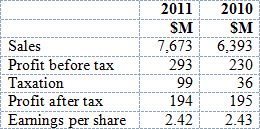

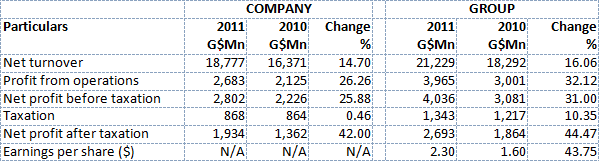

Highlights are set out in the table below:

The annual report is not heavy on discussion. As a result the reader is left to scour note 4, Taxation to the financial statements, to determine why a $63 million increase in profit before tax should carry a corresponding $63 million increase in taxes with the result that the after-tax profit in 2011 is marginally less than in 2010. The explanation lies in a higher deferred taxation which in 2010 benefited from a lowering of the applicable tax rate.

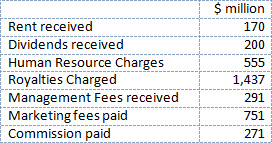

The company pays a significant portion of its expenses through a related party ($852 million in 2011) and also pays the related party $30 million as a “reimbursement for costs incurred.” This was the same amount paid in 2010.

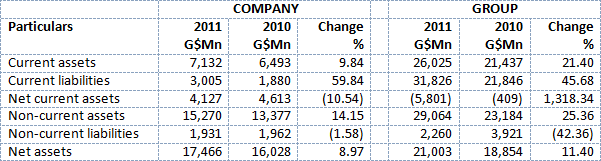

Expenditure on property, plant and equipment was $76 million and the overall decrease in cash was a substantial $240 million with the result that liquid balances declined from $304 million to $60 million. Faced with this situation the directors of the company are not recommending a dividend for the year 2011.

Minority shareholders in neither of these companies will be particularly happy.