Introduction

Last year when the Guyana Bank for Trade and Industry published its annual report for 2009 Business Page interrupted its series on the state-owned Guyana Sugar Corporation. GBTI’s 2010 annual report similarly interrupts a series of articles on the 2011 budget for the principal ministries of the government.

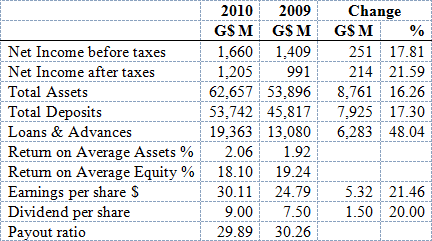

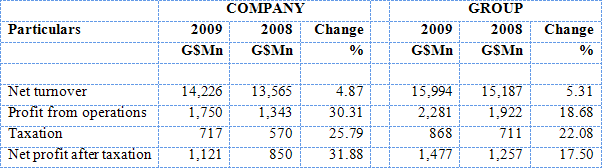

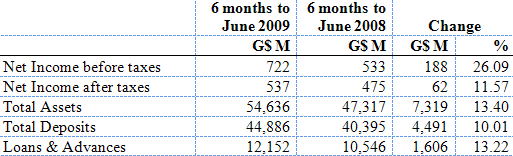

Another similarity this year is the remarkable growth of the Bank particularly in terms of after-tax income which in 2010 increased by a substantial 21.6%, easily surpassing the 5.3% growth in after tax income in 2009 over 2008.

The satisfaction with the results was writ large on the face of Chairman Mr Robin Stoby and in his enthusiastic and lofty prediction of the bank’s future as “luminous in the vein as our head office” and the realisation of the Bank becoming “the leading bank, not only in Guyana but also further afield.”

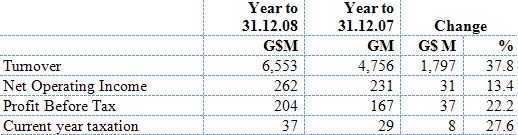

While there may be some over-enthusiasm in the Chairman’s predictions, they are understandable with net income before taxes increasing by 17.8% in 2010, 25.8% in 2009, 14.8% in 2008 and 23.9% in 2007, making for a cumulative increase since 2006 of 110.6%. Because of the tax effect, after-tax profits have increased cumulatively over the same period by 138.1%.

Performance

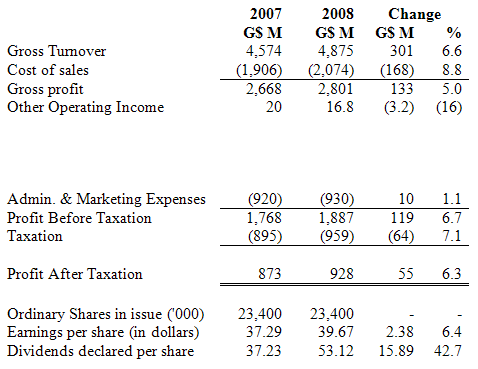

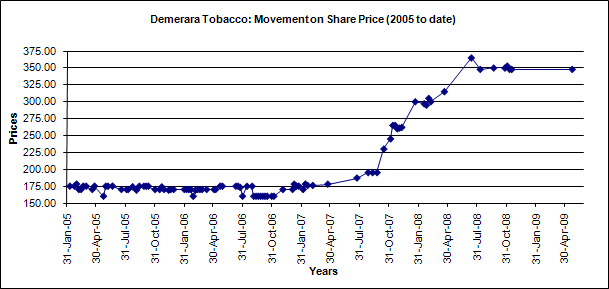

Earnings per share for the year were $30.1 in 2010, a significant increase from $24.8 in 2009. With the last trade in the company’s shares happening on January 31 at $163, the P/E ratio would be 5.4 compared to 5.6 just under a year before. No offers to sell the Bank’s shares were reported by the local stock market last Monday while the best bid price was $180, theoretically giving a P/E ratio of 5.98.

Given that per-tax income actually grew at a slower rate (17.8%) than in 2009 (25.8%), the enhanced after-tax performance has to be attributed to the lower effective rate of corporation tax which in 2010 was 24.5% compared with 26.2% in 2009.

This of course compares with the nominal rate of corporation tax of 45% up to last year. No doubt the shareholders would have been happy with the announcement that the nominal rate of corporation tax on banks, commercial and telecommunication companies other than telephone companies is being reduced from 45% to 40% effective January 1, 2011.

Commercial banks also enjoy several shelters including on investment income arising in countries with which Guyana has double taxation treaties and certain categories of loans made by the bank.

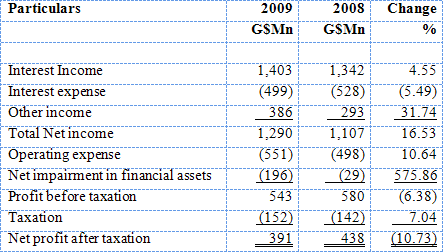

The interest earned on the average of net loan balances declined from 13.1% to 12.2% while the average interest paid on deposits was 2.1%, compared with 2.2% in 2009. The bank also consistently enjoys a high level of non-interest bearing demand deposits which averaged more than $12 billion during the year. Exchange Trading Gains fell from $733 million or 19.1% of total income in 2009 to $639M or 14.6% of total income in 2010, which took such gains below the 2008 level.

Loans and deposits

Deposits grew by $7.5B from $45.8B to $53.7B, an increase of 17%. Major sectors with increases were State Entities ($3.1B) and Personal ($4.6B), Deposits by the Commercial sector showed no increase while those by non-residents actually declined by 11% to $2.4B. The bank’s deposits increased slightly ahead of growth in deposits of all commercial banks, thus allowing it to increase its market share by 0.29 percentage points to 21.66%. Its market share of loans however could not be reliably determined as the total loans and advances figure published by the Bank of Guyana at December 31, 2010 excludes Real Estate Mortgage Loans.

The strong net increase in loans and advances came mainly in the Services ($2.8B) and Household ($2.6B) sectors. Since Household is wider than housing, it is not possible to ascertain from the financials the extent of mortgage lending from this categorisation.

Once a very strong player in the agriculture sector, the Bank’s loan portfolio suggests that this sector in no longer being emphasised and its growth in 2010 was a mere $73 million.

The Bank’s financial condition remains very strong and shareholders’ funds have increased from $5.7 billion to $6.5 billion.

In addition to providing several tax shelters, government support also comes in the form of treasury bills issued by the government that is prepared to spend billions to mop up liquidity. The bank’s stock of such bills is now $19.2 billion, while its loan portfolio has risen from $13.1 billion to $19.4 billion, an increase of 48%. Empirical evidence is that a substantial share of this is in the form of mortgages but strangely, the financial statements do not show this figure.

Related party transactions

Loans and advances to group companies totalled $660 million compared to $507 million at the end of 2009. Interest income was however recorded at $33 million on these facilities, an average interest rate of 5.69%. With a much higher average earned from the loans and advances portfolio (12.2%), it is difficult to see how the “rates of interest and charges have been similar to transactions involving third parties in the normal course of business” as stated by the Bank. On the other side, deposits by group companies were relatively stable at $1.1billion and interest paid averaged 2.46%, compared to the average on the total portfolio of 2.1%.

Insurance policies placed with a group company more than doubled from $2.1 billion to $5.0 billion.

Another related party is the law firm of Hughes, Fields & Stoby of which the Bank’s chairman is a partner. As with so many financial houses in Guyana, the Bank seems to place much of its customers’ borrowing business with a single firm rather than give the customers the expressed option of independent legal counsel.

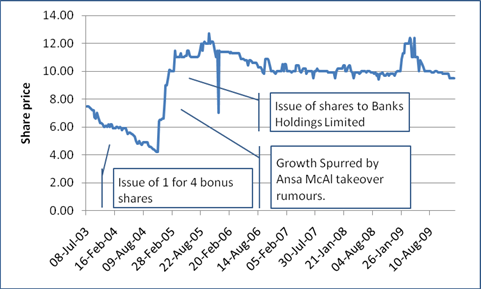

Share price

Only 1000 GBTI shares have traded since November 15, 2010 – a single trade on January 31, 2011. 251,500 traded between January 1, 2010 and November 15, 2010, more than half (140,000) of which traded on April 26, 2010 which is the week after the AGM. Share prices on January 11, 2010, April 26, 2010 and January 31, 2011 were $135, $160 and $163 respectively. The highest price for the year was $180 on April 12, 2010.

At $9.0 per share, total dividends in 2010 will represent 29.9% of the year’s distributable profits, compared with 30.3% in 2009.

Conclusion

The Bank is clearly on a growth mode and is so far the only bank approved under the small business amendment to the Income Tax Act; is the centre of the Women of Worth Scheme; and has started construction in Lethem, which will likely make it the first bank to open in that area. The Bank has also taken up an additional 10% shareholding in associate Guyana Americas Merchant Bank Inc. These are significant developments.

On the negative side, the Bank could be more forthcoming with information on its overseas investments and the various loan schemes it operates.