Introduction

The Duprey name is legendary in Trinidad and Tobago. Cecil Duprey, a member of an ordinary local family in a matter of decades rose from practically nothing to become a household name in his country. He founded a successful conglomerate, established a business that would probably have been considered too bid to fail and his grandson Lawrence Duprey had visions of taking the company global. He was street smart and while living his vision – first in the Caribbean and then further afield – played the political field as a major supporter of the corrupt Basdeo Panday government. Duprey seems to have won President Jagdeo’s confidence here in Guyana which seems to have made available to him and his company CLICO endless opportunities to invest in Guyana. For example, CLICO’s forestry subsidiary Caribbean Resources Limited was allowed to retain concessions over huge swathes of Guyana’s forests even though it had for years defaulted on its obligations to the Guyana Forestry Commission. Duprey was preferred to DDL for GuySuCo’s molasses and was negotiating for an investment in an ethanol plant.

Mr Lawrence Duprey surrounded himself with some bright accountants, including Andre Monteil, a classmate of mine at South West London College from 1970 to 1973. Monteil is credited with being a key architect of CLICO’s expansion and some of its more aggressive and possibly illegal activities. While Monteil’s role in some transactions made him quite unpopular in Trinidad and Tobago, for the better part of two years, it was felt the Mr Duprey was untouchable. That belief was shattered this past week in Trinidad and both gentlemen are now in some real problems.

Double whammy

Reports emanating from Trinidad and Tobago suggest that the government of that country is moving against Lawrence Duprey and Andre Monteil for civil and or criminal conduct in the collapse of the insurance giant CLICO and its parent CL Financial. A civil lawsuit was filed last Tuesday by Trinidad’s Central Bank and CLICO against Duprey and Monteil for alleged mismanagement and misappropriation of CLICO assets which led to the fall of CLICO in January 2009. Then one day later Attorney General Anand Ramlogan directed that all files coming out of the probe into the collapse of insurance giant CLICO should be forwarded to Director of Public Prosecutions (DPP) Roger Gaspard to determine if criminal charges should be laid against Duprey and Monteil. The two hundred page suit should make interesting reading indeed.

Under normal circumstances the authorities in Guyana and the former key officers in CLICO Guyana should be taking great interest in the developments taking place in Trinidad. While the architects of the financial misadventure that has placed our National Insurance Scheme at risk were those in Trinidad, they found compliant Guyanese to carry out the Guyanese leg of transactions, even willing to ignore the country’s laws and defy its regulator. This column had previously called on the Bank of Guyana which has taken over responsibility for regulatory control of the insurance sector to work closely with its counterparts in Trinidad in the investigations and prosecutions of the region’s most expensive financial failure.

Deafening silence

So far we have heard nothing but a deafening silence from the Bank of Guyana whose Governor has, probably dangerously, been appointed the company’s liquidator. I say dangerously because it is not unusual for legal actions to be brought against a liquidator and the person most likely to do so would be the regulator. That is not going to happen even as the liquidation has in essence been contracted out! Indeed my understanding is that CLICO’s former CEO Ms Geeta Singh-Knight is still playing a paid role in the liquidation. We are truly an incredible country.

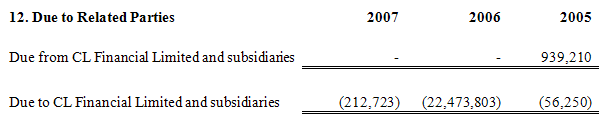

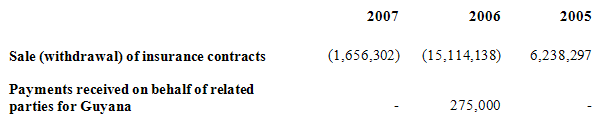

The CLICO debacle in Guyana has been addressed to some considerable degree in these columns before. I do not intend to do so again. Suffice it to say that the company had breached the provisions of the Insurance Act which require companies carrying on long-term insurance business to invest a base of 85% of its statutory fund in Guyana. In clear contravention of that legal requirement CLICO took the billions of dollars in the Fund and placed it in a related party in The Bahamas, incorrectly claiming that it was invested in Fixed Deposits, a matter that appeared to have escaped the diligent notice of CLICO’s auditors. The directors and officers of CLICO did not comply with a demand/request by the regulator to repatriate the Statutory Fund.

Trouble

Enter the law. Section 19 of the Insurance Act provides that any person who contravenes any provision of the Act, or any of its regulations or any direction or requirement made by the Commissioner of Insurance, is guilty of an offence. Unlike the normal presumption in law where the prosecution has the burden of proving beyond reasonable doubt the guilt of the accused, the Insurance Act shifts the burden to the “person” to prove that s/he did not knowingly commit the offence of omission or commission.

Sub-section (2) of the section provides that where an offence is committed by a company – in this case CLICO – and the offence is proved to have been committed with the consent or connivance of, or to have been facilitated by any neglect on the part of, any director, principal officer, or other officer or an actuary or auditor of the company, he, as well as the company, shall be deemed to be guilty of the offence. Ms Singh-Knight was both a director and principal officer of the local company and most certainly it would have been to Ms Singh-Knight that the Commissioner of Insurance would have been addressing correspondence and directions.

There is no doubt in my mind that as the new regulator the Bank of Guyana should have long initiated action against the officers and directors of CLICO Guyana, and that the failure by the BoG amounts in my view to a serious dereliction of duty. Now when the regulator fails, for whatever reason, to protect the public interest, there is trouble indeed. That is the situation we face.

Duprey and Monteil

The question has been posed to me whether Guyana can take similar action here against Duprey and Monteil. That is a question for really seasoned attorneys to answer. The Insurance Act recognizes that insurance may be offered in Guyana by persons who are not in Guyana. In fact the Act defines a person as including “a natural person and any corporation or other entity which is given, or is recognized as having legal personality by the laws of any country or territory.”

The challenge is that the laws of Guyana are generally only enforceable in the country’s courts and the question is under what law can the courts of Guyana compel Mr Duprey to submit to its jurisdiction. Article 38 of the revised Treaty of Chagauramas imposes an obligation on member states of Caricom, within defined limitations, “to remove discriminatory restrictions on banking, insurance and other financial services.”

Oddly, the treaty created a single economic space but left territorial jurisdictions intact, impervious to each territory’s domestic laws. The Caribbean Court of Justice only has original jurisdiction in relation to the treaty and the CSME and appellate jurisdiction from national courts. It may seem commonsensical that crimes or contraventions of provisions of the treaty committed in any territory should be dealt with in that territory. It is certainly worth further consideration and one only has to look at how the US used the long arm of its laws to bring to justice ‘Sir’ Alan Stanford for financial crimes committed in Antigua which defrauded Americans back home.

Local directors

But back to the directors of the local company and in particular Ms Gita Singh, its CEO who was at the centre of the questionable and disastrous transactions. In addition to the infractions of the Insurance Act there were clear breaches of the Companies Act (CA) which governs all companies incorporated or registered in Guyana. S 96 of the Act imposes on every director and officer of a company a duty to (a) act honestly and in good faith with a view to the best interest of the company; and (b) exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances.

In the discharge of their particular duties which they have assumed, directors are bound to take reasonable care. Failure to exercise such care constitutes negligence. While the normal legal principle is that directors owe their duty to the company and to no one else, directors may be liable to outsiders for their own wrongs. This means that directors who are parties to a fraud or the commission of any other wrong are personally liable on the general principle that a servant or agent who commits a wrong is liable for damages resulting therefrom as well as the company.

Time to act

We should long ago have started an enquiry into CLICO for possible criminal conduct and the Bank of Guyana should, like their counterparts in Trinidad and Tobago, have begun civil action against them and their Trinidadian masters. This would have been an excellent opportunity to expand on our jurisprudence while penalizing those who break our laws and cause our people and country huge losses.

It may be that the Bank of Guyana is afraid to take action because President Jagdeo has stood by Ms Singh-Knight while he throws red herrings about investigating Globe Trust and CLICO. There must be some good reason for him to want to do so but his failure sends the wrong signal that some people can do no wrong and if they do, there will be no consequences.