Introduction

In today’s Business Page we look at two reports – one on full year 2008 of the Guyana Stockfeeds Inc, published under the Companies Act 1991, and the other the half-year report of the Guyana Bank for Trade and Industry (GBTI) published under the Securities Industry Act, 1998. Because of the significantly different nature of the operations and the nature of the financial information and period ends of the two entities, no useful comparisons can be drawn and the appearance of the two reports in the same column is entirely co-incidental. Indeed, if any comparison can be drawn it is the poor quality of the editing that goes into these reports, leaving major errors, sometimes in the financial statements themselves, at other times in the narrative reports and yet others in both. For GBTI some of these were pointed out in a guest column in these pages by Robert McRae CPA on the 2008 Annual Report of the bank.

Such errors are often attributed to difficulties with printers but neither the management nor the auditors can absolve themselves from their duty to members and the public to have annual reports and accounts that meet minimum quality standards.

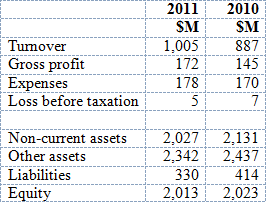

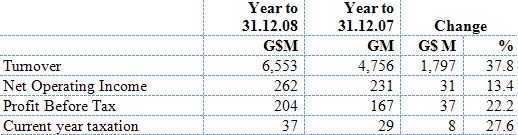

Guyana Stockfeeds Inc.

Highlights

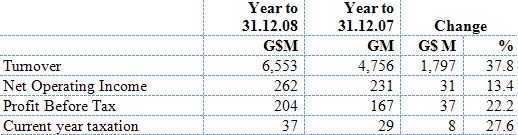

Despite what the Chairman referred to as “enormous challenges” the company recorded an increase in turnover of some 38% with sales of rice doubling while feed sales and hatchery sales increased by a more modest 29% and 21% respectively. As expected the Chairman was particularly pleased about the performance of the company’s brand of parboiled rice ‘Angel’ on the export Caricom market.

Of the net income for the year of $123M, after allowing for deferred taxation, the company proposes $60M in dividends or 49%. Dividends of $96M in respect of 2007, of which 50% is payable in additional shares, remain outstanding. The payment of dividends by the issue of shares was not effected as a result of a court matter with the National Industrial and Commercial Investment Limited.

How the company intends to fund the cash portion of dividends totalling over $100M is, however, not quite clear as the company’s liquidity position has deteriorated with the bank overdraft more than doubling to just under half a billion dollars and current liabilities other than dividends increasing over the 12-month period from $597M to $1,069M. Interestingly note 12 of the financial statements indicates that the company had exceeded its overdraft limit of $440M by more than $40M.

As is so common with public companies in Guyana, there is no mention in the annual report or the Chairman’s Report on the performance on the Stock Exchange of the company’s shares, although this may be entirely due to the fact that there is practically no trading in the company’s shares and that the company is developing into a family company with three of the top positions – CEO, corporate secretarial and finance – being held by members of the same family, which also holds some 69 million of the 80 million shares issued. This company is evidence of the permanent failure of the government’s privatisation policy, driven more by maximising short-term returns than long-term economic democracy. In all the government’s boast about macro-economic fundamentals, it does not appear to recognise that it has divested some highly profitable entities and has little to show for the proceeds. It is too late now for it to review the Privatisation Policy Paper issued under the presidency of Dr Cheddi Jagan, although it was under his presidency that we first saw the departure from policy under then Finance Minister Asgar Ally.

Accounting weaknesses

An observer of accounting and other disclosure requirements would find much of interest in terms of the contents of the Annual Report and the quality of the financial statements, even ignoring an obvious error of $400 million on the face of the balance sheet, which some may regard as the most important of the financial statements. These relate to the dating of the auditor’s report before the financial statements were even approved by the board, inconsistency in particulars about who the company recognises as key management personnel, disclosure about shareholdings, actuarial valuations and tax reconciliations.

That the company continues to pay US$50,000 management fees to a similarly named Trinidad and Tobago company for the payment of expenses on its behalf has continued to attract negative comments, since the logic and business purpose is not immediately apparent. On the other hand, the low effective tax rate suggests that the Revenue accepts the charge as reasonable having regard to the company’s business.

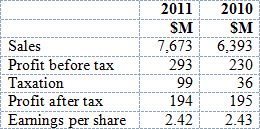

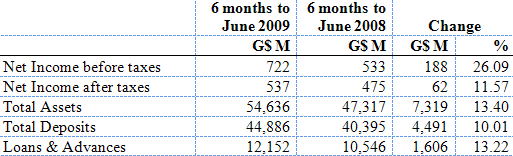

GBTI

In contrast to the financial statements discussed above, those of the GBTI are unaudited and cover the half-year only. In addition, there is no requirement for an Accountant’s Review or notes explaining the policies and judgmental matters relating to key financial statement items, and it is probably these limitations that explain the apparent lack of interest by the public and the business community in such half-yearly reports. Such statements should not be disregarded, since it must be assumed that they result from the accounting records prepared, subject to the limitations identified, in accordance with acceptable accounting standards.

Highlights

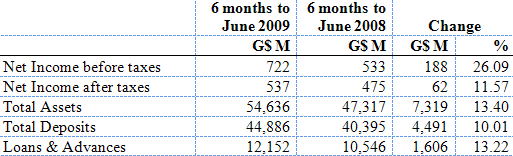

The bank’s performance for the half-year continues a run of excellent results not only for GBTI but indeed for all the commercial banks over the past three years. As the table above shows the bank has increased both deposits and loans, but with a barely discernible increase in the loan to deposit ratio. Our banks are performing so well that any observer of our banking sector would be bemused if told about a global financial crisis, although the anecdotal and empirical evidence is that the non-financial sector is having a lean time. We should therefore be anticipating with interest the publication of the 2009 mid-year report by the Minister of Finance which is unfortunately again late.

Net income before taxes has increased by a whopping 26% over the corresponding period in 2008, while the amount of $164.8M stated as Corporation Tax is the equivalent of 23% of net income. This represents a significant increase in corresponding equivalent percentage for 2008 when it was less than 9% and in the low teens for full-year 2008. This increase is so significant both for the corresponding period in 2008 as well as full year 2008 that we can only wait on the audited full year for some more evidence of such a dramatic swing over such a short period.

Tax policy

Robert McRae, CPA who did a guest column on the bank’s 2008 annual report had drawn attention to the bank’s effective tax rate and how little our economic managers seem to know or care about tax policy. A significant part of the problem is the VAT, a tax borne not by businesses but by consumers of goods and services. Guyana is stuck with a hugely miscalculated VAT rate that has masked any other concern that the government may have had about revenue collection.

In his column McRae had also raised the ire of the bank and the Bank of Guyana when he drew attention to a transaction between the bank and the Bank of Guyana, particularly in the context that the bank had for a second straight year had a significant deficit on its statutory reserve with the central bank.

The Bank of Guyana with unusual speed and generalisation reacted to the column but significantly has refused to answer some specific questions raised publicly by McRae. While commercial banks are, and indeed every person is, entitled to responsible financial reporting, they have a duty to respond to legitimate questions from the public on issues touching on their operations.

GBTI’s Chairman Stoby was noticeably pleased with the results and is upbeat about the bank’s performance for the second half of the year. Those results will certainly be eagerly awaited, but before then we will have some of the other banks including Republic Bank which has a September 30 year end. It will be an interesting period.