Introduction

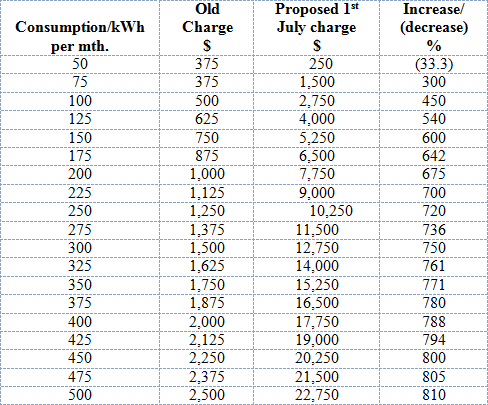

As this column evolved over the past month its focus moved beyond Linden and electricity to the whole of Region 10 of which Linden can be considered the capital. The column which concludes today was in response to developments in that region in which the drastic hike in electricity rates led to protests, deaths and what will soon come to be known as the Region 10 Agreement. That agreement, signed by the Chairman of Region 10, Sharma Solomon, and Prime Minister Samuel Hinds on behalf of the Government of Guyana provides for a Technical Team specifically to look at the question of electricity; an Economic Committee to address the economic conditions in the region, a Commission of Inquiry to look into the events of July 18 in which three persons were killed; the establishment of a Region 10 Land Selection Committee to look at investments and land development in Linden and Region 10; and for the transfer to the regional administration of the television dish and transmitter and the granting of a television licence to the region.

The agreement provides for the naming of the Economic Committee by Tuesday of this coming week and for it to submit its final report “within ninety days.” While the members of the Technical Committee have been named as proposed by the region and the government, this column has learnt that the designated persons are awaiting formal notification of their appointment which makes the ninety days to report even more challenging.

Unfortunately ‘normal’ in executing agreements in Guyana is often synonymous with procrastination and more like a long-distance hurdle, with President Ramotar’s Tax Review Committee only one recent example. At this stage all the details of the Commission of Inquiry have not been made public and it is unclear when the commission will be assembled to begin its work.

Time for action

This column calls on the parties to the agreement to accelerate the rate of activity.

In this concluding part which seeks to look at the prospects for economic development in the region, the unsatisfactory state of available and reliable baseline data is an immediate problem. Indeed one of the terms of reference of the Economic Committee is to “examine the employment situation of Linden in particular and Region 10 in general…” That is not only an enormous task but also an enormously important one with direct relevance for affordability, one of the matters into which the Technical Team is required to enquire. As time would have it, that task is made more challenging by the fact that the committee might not be able to call on the services of the Bureau of Statistics which is now engaged in the national ten yearly census.

Accordingly, the members of the Economics Committee will have to be resourceful in how they approach the gathering of information and explore places like GECOM, the ministries and other agencies which would have collected some economic and social data for their respective purposes.

Economic plans

One of the other terms of reference of the Economic Committee requires it to “examine all studies, all plans, all sectors and their resources in use, new resources and human resources and develop a sustainable plan for Linden and Region 10.” There have indeed been a number of plans which the committee will find most useful and which with some updating could constitute a useful starting document. But I fear that the ninety days deadline for completing the work will require economists of herculean ability. Both Dr Clive Thomas who is generally regarded as the country’s best economist and Mr Haslyn Parris who is very familiar with the economics of the region are on the Technical Team looking into the electricity issue, which has the same deadline.

But let us leave the committees to do their work and get on with our own and look at the economic and development prospects for Region 10. Despite its not so positive image of bauxite, the region is rich in other natural resources.

Giving away the store

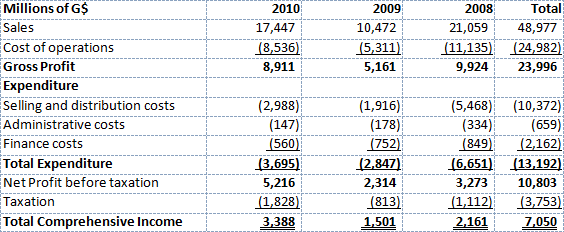

Region 10 is one of those regions for which tax holidays are provided for under the Income Tax (In Aid of Industry) Act. To qualify, the economic activity must be new, of a developmental and risk-bearing nature and demonstrably create new employment. The power to grant tax holidays rests with the Minister of Finance who also has wide powers to enter into investment agreements which could give businesses additional and valuable wide-ranging concessions. To give an idea of the width of the discretion and the possibilities for abuse and misuse of the law, one only has to look at Bosai and Rusal, neither of which undertook new economic activity nor demonstrably created new employment. Indeed they slashed employment in an existing activity but were yet given tax holidays.

Unfortunately because of the politicisation of the tax system none of the ten administrative regions has any power to attract or direct businesses to their regions. Tax incentives and concessions provided for under the laws including tax holidays as well as the powers to enter into investment agreements, are entirely controlled by the central government. Some participation and control were clearly contemplated by Article 76 of the Constitution which anticipates Parliament making laws enabling “regional democratic councils to raise their own revenues and to dispose of them for the benefit and welfare of their areas.”

Contrarily, the government has been improperly giving away tax revenues which the law requires them to impose and then turns around and tells the regions it has no more money to spend on them. Similarly the Constitution at Article 77 A requires the Parliament to make laws providing “for the formulation and implementation of objective criteria … for the allocating of resources to, and the garnering of resources by local democratic organs,” again emphasising the right of regions to raise revenues.

The importance of good governance

Still on the governance issue the constitution sets out as a fundamental right the participation of persons through various kinds of organisations in the management and decision-making processes of the state. And then there is article 78 A which requires the Parliament to establish a Local Government Commission which together with the other provisions will ensure better governance and democracy at the regional level.

Unfortunately all the regions of the country have had to contend with years of shocking failure by their representatives in the National Assembly to bring the necessary laws to ensure that the constitutional provisions are effected. Our parliamentarians must be the only people not to recognise how fundamental these are to the development of Region 10, as indeed to the rest of Guyana.

I have always believed that good governance is a necessary prerequisite for social and economic development, and that good economics always turns out to be good politics. Maybe the Region 10 Chairman should meet with his counterparts to persuade them to press their parties to do what the constitution has provided in the interest of the people of the regions. If they do not wish to play ball in their own interest, then region 10 will once again have to show the way.

Regional Development Strategy

Assuming these governance issues are addressed, the question for the Economic Committee is how to achieve their objectives in 90 days, a challenge which even Jules Verne would find daunting. Fortunately there is a document called the Regional Development Strategy for Region 10 which was prepared not too long ago with input from LEAP (referred to in an earlier part of this column), the government, the EU and the UNDP.

And as I mention the LEAP, I should update readers with a conversation I had with a high-ranking government official who suggested to me that the reason for the runaround I had to get a copy of the LEAP Completion report is that that report never got beyond the draft stage. While I consider my source just short of impeccable, I am astounded that the European Union would have spent €12.5 million without a completion report on the project!

On the other hand, the Regional Development Strategy is a document which could form the basis of the work of the Economic Committee. That report identified as the vision for the economy five engines of growth: agriculture, forestry and wood value- added manufacturing and other skill-based industries absorbing the increased technical output of our schools and technical institutions, tourism and transportation.

The strategy recognises that bauxite mining will continue in Linden and at Aroaima. It asserts that a study to determine the feasibility of constructing an aluminum smelter in Linden has confirmed its viability while kaolin and laterite are developed within the bauxite industry to complement the traditional metal, chemical and refractory grade bauxite.

The strategy also includes a vision for environmental stewardship, the social sectors and governance and institutional capacity, but did not appear to have addressed the constitutional issues. Paragraph 2.4 of the strategy identifies “Region 10 [as] crucial to the development of Guyana. Its geo-strategical position as a gateway to Brazil, its central location in the heart of the country bordering six other regions, its span over the three major rivers, and its weight in the national economy (particularly bauxite mining) make it an outstanding region compared to others.”

Conclusion

But the document goes further claiming with justification that the elaboration of a Region 10 Development Strategy as a pilot project in Guyana and a harbinger for similar strategies in other regions gains critical importance in the national context. While some of the methods the leadership of Region 10 has pursued have not won universal approval, the community itself has demonstrated to the rest of the country that central government habits die hard and sometimes have to be pushed out of the way to make room for development.

The next ninety days and how the government responds to the reports of the Technical Team looking into electricity and the Economic Committee with a broader mandate, will signal the direction in which the country will go. Favourable and it could be a model for success. Failure to act will cause failure all around. The government remains key but not exclusive.