Introduction

Column 37 which appeared last week dealt with the classification of costs and as indicated there, attention now turns to what Annex C describes as Pre-contract costs. In this regard, a major insertion in the 2016 Agreement which has aroused considerable curiosity relates to an amount of US$460,237,918 by the Contractors for pre-Contract costs incurred under the 1999 Agreement. This is included in section 3.1 of Annex C “Costs Recoverable Without Further Approval of the Minister”. This is also not the entire sum for pre-contract cost but represents only those costs claimed to have been incurred up to December 31, 2015. Additionally, the 2016 Agreement also provides that cost incurred between January 1, 2016 and the Effective date of the Agreement constitute part of the cost of petroleum operations. All that was required in the latter case was for the Contractor to notify the Minister of those costs no later than October 31, 2016. The Minister had six months to agree such costs.

The separation of the two costs suggests that the US$460,237,918 is final while in the case of the costs incurred between January 1, 2016 and the effective date, the time for any challenge was April 30, 2017.

Intersection of law and accounting

All companies, whether incorporated locally, or incorporated abroad but registered locally, are required to file an annual report together with financial statements. Such financial statements should provide reliable information for users, including regulators. At a minimum therefore, before accepting the figure of US$460,237,918, Minister Trotman should have verified it to the December 2015 audited financial statements filed with the public authorities. It is difficult to see how this could have been done since the public records show that only Esso and CNOOC had complied with the requirement for the filing of records. What Trotman would have realised was that the other Contractor – Hess Corporation – has never filed a single financial statement or annual report with the Commercial Registry! Surely, this is elementary stuff which requires basic knowledge and common sense.

The 2016 financial statements of Esso reported that in 2014 it had entered into farm-out arrangements with Hess and CNOOC/Nexen and that Government approval was still pending, i.e. two years later. CNOOC reported the relationship differently, describing it as Joint Arrangement. To complicate matters further, Hess which did not make any local filings, reported to its international stockholders that it had acquired a “working interest”, which is another term for farm-out. To add further to the complexity, in 2008, Esso had entered into an Assign-ment Agreement and a Farm-out Agreements which would have also had financial implications.

Intricacies of accounting

What is significant about these differences is that depending on the nature of the arrangements, they require different accounting treatment including how the gain arising from the farm-in, farm-out or sale of a working interest ought to be recognised. A newspaper column is not the place for the intricacies of oil and gas accounting. Suffice it to say that according to CNOOC, its interest was acquired from ExxonMobil and perhaps explains why there is no gain or income reported in the accounting statements of Esso.

The 1999 Agreement required the contractor to bear and pay all contract costs incurred in carrying out petroleum operations, allowing for the recovery of contract cost only from cost oil (sic) as provided in the Agreement. While the definition of “Contract costs” as “exploration cost, development cost, operating costs, service cost, general and administrative costs and annual overhead charge” seems particularly wide, the meaning is restricted to costs incurred in carrying out petroleum operations. That term is defined in the 1999 Agreement to mean “prospecting operations or production operations as defined in the Act”. In turn, “production operations” is defined as “operations carried out for, or in connection with, the production of petroleum” while “prospecting operations” is defined to mean “operations carried out for, or in connection with, exploration for petroleum”.

What this means is that costs, including travel, administration, etc. incurred other than in petroleum operations, are not recoverable costs and Minister Trotman and his team should have been alert to the separation of such costs. There is no indication that Mr. Trotman exercised any such diligence, opening the real possibility of costs being imposed on Guyana that are way outside of both the 1999 and the 2016 Contracts. In fact, if Mr. Trotman had consulted with the Commissioner General he would have realised that the Income Tax Act sets out the principle of recovery of petroleum production capital expenditure.

Numbers not adding up

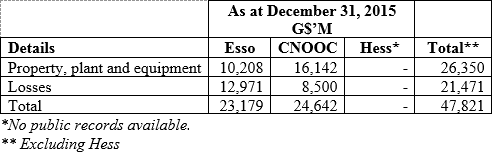

Here is a summary of the financial statements of the three contractors:

As the Table shows at December 31, 2015, Esso had property, plant and equipment (PPE) of G$10,208 million and losses of G$12,971 of which $9,617 million, or 75% was incurred in 2015. There is an amount of $1,133 million under Exploration costs in 2015 being an unexplained credit. Now, even if we were to make the unlikely assumption that all of Esso’s expenditure constituted legitimate pre-contract cost to December 31, 2015, at its highest, Esso’s portion of the G$92 billion (US$460 million) would be G$23,179 million.

CNOOC at the same date had PPE of G$16,142 million and losses of $8,500 million, making a total of G$24,642 million. The financials of CNOOC describe the G$16,142 million as expenditure on “Exploration and Evaluation assets consisting of exploration projects which are pending the determination of proven or probable reserves.” Forget for a moment that this is another clear violation of the ring-fencing principle which seeks to match expenditure to projects. It means that the burden and risk of exploration has been shifted from the oil companies to the taxpayers of Guyana. As the fired US FBI Director, James Comey would say, Oh, Lordy!

The combined expenditure of Esso and CNOOC at December 31, 2015 was PPE of G$26,350 million and reported losses of G$21,471 million, giving a total of G$47,821 million. In United States Dollars using a $200 rate gives a total US$245 million, well short of the $460 million that the Government has accepted in the Agreement.

To make up the total of US$460 million, Hess alone would have had to spend, in contract costs some US$215 million or approximately G$46,000 million! That defies logic and credulity. But there is more. It must be a stretch that the pre-contract cost of CNOOC which only entered the sector in Guyana in late 2014 would have incurred greater contract cost than Esso. And an even greater stretch that Hess which signed with Esso in late 2014 would have spent nearly as much as Esso and CNOOC combined!

Recall that Esso signed its first Petroleum Agreement in 1999, fifteen years earlier, and it is the company which has been reporting all the oil discoveries. That either CNOOC or Hess which entered the sector in late 2014 would be outspending Esso arouses particular interest. And in so far as Hess is concerned, any claim for pre-contract cost is weakened by its failure to file annual returns and audited financial statements.

Special Audit required

This whole business of US$460 million of pre-2016 contract cost has become too much of a public matter to leave to rest. Or to the fact that the Minister signed as agreeing the amount without any thought of its significance or implication. Having looked at the available information, it is hard to avoid the conclusion that the US$460 million cannot be explained on any rational basis.

The only satisfactory and acceptable resolution of this matter is a SPECIAL AUDIT independently undertaken, and including a review of the farm-in and farm-out agreements with Shell, Hess and CNOOC.

I will wrap up this segment on the comparison of the 1999 and 2016 contracts in Column 39.