Dear Editor,

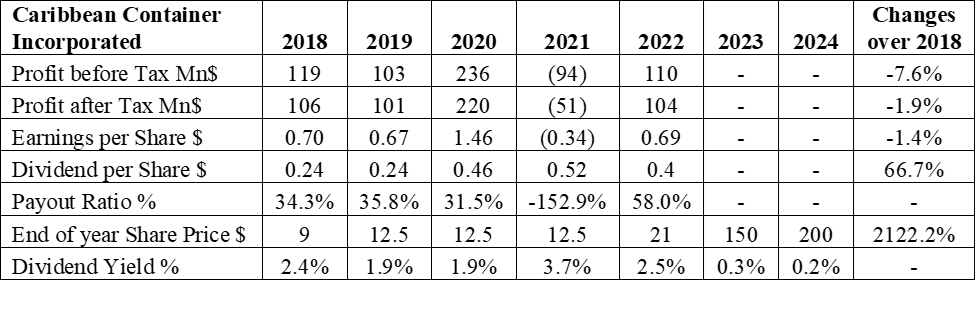

One of our other public companies – Caribbean Container Inc. (CCI) – seems to have an even more serious problem with its share price than Banks DIH Limited does. Between the Stock Exchange (GASCI) trading session 1007 on 20 February 2023 and trading session 1057 on 5 February 2024, the price of CCI’s shares has skyrocketed from $40 to $200. There is nothing in the fundamentals of that company (see Table below) that could conceivably justify anything close to this 400% increase in the share price over a 1-year period. In fact, if we go back one year earlier to 27 June 2022 when the price was $15, the increase is a staggering 1,233%!

The only noteworthy development in the Company is the leasing of part of its property which will generate a steady flow of income in the immediate future.

Source of Information: Annual Reports and GASCI Website

The principal shareholders in the company are Demerara Holdings Inc., whose ultimate beneficial owner is the estate of its former Managing Director, which owns 85.92% of CCI’s shares, and Secure International Inc., a Beharry Group company which owns 5.16%. The Securities Industry Act requires disclosure of 5% or more.

The number of shares traded between February last year and this month to date, was 66,400 and between 27 June 2022, that number was 90,200. For completeness, the average number of shares traded over eighteen sessions was 3,688 shares. This represents just 0.059 % of the 150,916,595 shares in issue. It ought not to be that transactions involving 0.059% of shares in issue can move the share price by 1,233%! While this is an extreme case, such distortions are not unique to CCI as the trading records of DDL and Banks DIH show.

I am not suggesting any insider dealing or other improper conduct on the part of any person, including CCI’s management. But rather that something is wrong with the working of our Stock Exchange, its shareholdings, market participants and shareholder and investor education. There is a lot of blame to go around, including misleading information in annual reports and peddled by chairpersons of public companies.

Part of the solution lies in meaningful reform but efforts to get successive governments to pay attention to both GASCI and the Securities Exchange have produced little or no fruit. I am hopeful that the recent comments published in the Stabroek News on Banks DIH Inc. and now this extreme disclosure will stir the powers that be into some meaningful action.

An immediate course of action would be for the Stock Exchange to immediately suspend trading of shares in this company, and to make inquiries and appropriate recommendations. We cannot at the same time boast of a world class economy and have an imperfectly functioning Stock Exchange.

Christopher Ram