Comment

Ram & McRae has identified and announced as one of the activities and initiatives for its 25th anniversary being observed this year, an award for the best Annual Report by any Guyanese company. The selection will be made by a panel of independent professionals from the business community, academia, the Guyana Bar Association, consumer representatives and the media.

In deference to the firm and in order to avoid any appearance of, or in any other way influencing that panel, Business Page and this feature will restrict its analysis of the annual financial statements and reports of public companies in Guyana to matters contained and disclosed in those reports and accounts. It will avoid identifying, as far as is consistent with a proper analysis of those reports, any defects or deficiencies, and will be less judgmental in its evaluation and interpretation of those documents. A consequence of this approach will be that the column will not be offering any public recommendations for addressing any perceived or actual deficiencies.

I hope that this does not detract from the interest which readers have shown in this feature over the years, which has on many occasions caused the column to be at odds with some of the companies.

Introduction

Today’s Business Page looks at the financial statements of the two operating companies of the Banks DIH group. The group comprises Banks DIH Limited (‘Banks’), the food and beverage giant, Citizens Bank Limited, a 51% owned retail bank and Caribanks Shipping Company Ltd, a dormant company. The financial statements of the group also include as an associate company B&B Farms Inc, a Guyana private company and BCL (Barbados) Limited in which Banks holds a 25% interest. The financial statements of the group do not treat as an associate Banks Holdings Limited, a company in which it owns 8.6% of its issued capital, has a director on its board and with which it had transactions valued at $150 million during 2009. On the other hand, Banks Holdings which owns 20% of Banks and which has two directors on the board of the Guyana company, treats Banks Guyana as an associate in its books.

Both the public companies in the group have as their accounting year-ends September 30 and will be holding their annual general meetings later this month – Citizens on January 19 and Banks four days later. The shareholdings in the two companies reflect an interesting contrast with Banks spreading 60% of its shareholdings among a vast network of private individuals, while in the case of Citizens, four shareholders own 82% of the shares with the remainder spread among about sixty smaller shareholders.

Banks will be presenting a regionally designed and produced high-quality, glossy report in which the Chairman and CEO waxes lyrical about the iconic role of the company in the landscape of Guyana. The report of the bank in contrast, is done with the standard cover in which only the year is different. One other issue of difference is the structure and contents of the reports of the two companies which have different governance structures, with Banks having an Executive Chairman, the American model, while Citizens has split the roles of Chairman and Chief Executive Officer, the European model.

Banks has eleven directors, five of whom overlap with the nine in Citizens. In both cases, all are male, even as this week’s Economist shows on its cover a blue-collar woman flexing her muscles and boasting “We did it!”

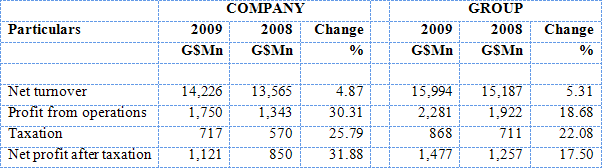

As the Chairman pointed out in his report, the net profit of the company passed the significant one billion dollar milestone for the first time in its history, with a 32% increase over 2008. Those profits were earned on increased turnover of 5% which would be slightly ahead of the official inflation rate for the country. Net operating costs rose by a smaller 2.1% compared with an increase of 4.9% in 2008 over 2007, but with staff costs increasing by just under 10%, about double the rate of inflation. Costs for key management increased by 13.07% while for other staff the increases averaged 10.69%.

A significant contributor to the better performance reported in this year, however, is a write-back of $474 million arising from a favourable settlement of an excise tax issue between the company and the Guyana Revenue Authority. In 2007 and 2008, the company made provisions of $183M and $291M for potential excise taxes and the published half-year report at March 31, 2009 showed a cumulative provision of $617M.

Reflective of that agreement, the Profit and Loss Account for the year shows a reduction in excise tax of $268 million over 2008 or an effective rate of 11.7% of sales compared with 15%. If the write-back, which is a non-recurring benefit, is excluded from the current year’s profit the net after-tax profit for the year would have been $813M. When compared to a profit for 2008 of $1,039M (adjusted for the excise tax provision made in that year), the company would have reflected a fall in profitability of 21.72%, despite the increase in sales.

Partly due to the write-back, all the profitability ratios show increases over the preceding year, but so too do the other ratios which are less, or not directly affected by the write-back, such as activity, liquidity and solvency ratios. Both current as well as long-term liabilities have declined while current assets have increased as have cash resources which increased by $481 million or 37% over 2008.

The average rate of tax charged in the accounts for the current year is 39%, a marginal decline over the previous year. Current year taxation has jumped from 34% in 2008 to 43% in 2009, with property, withholding and capital gains tax accounting for a smaller percentage this year (11%) than in 2008 (16%). High rates of taxes and the non-deductibility of Property Tax have been a major concern of this group and the manufacturing sector for decades, but such concerns have largely been ignored by the government and such groups as the National Competitiveness Strategy Council, in which the private sector has significant representation without any apparent comparable influence.

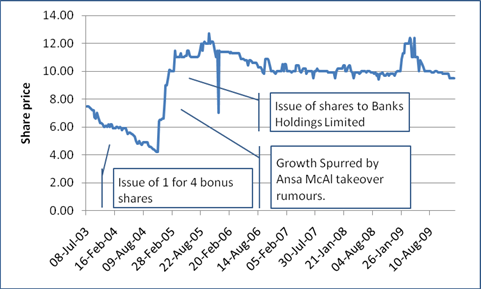

As a result of the attempt by a regional group to wrest control of the company and the company’s defence strategy, the company’s share price based on transactions reported by the Guyana Stock Exchange, has shown a high degree of volatility. During the year, the company’s share price fell from $10 to $9.50, or by 5%, and is now at its lowest point since September 2008.

Share price

Source: Guyana Stock Exchange

Citizens Bank Limited

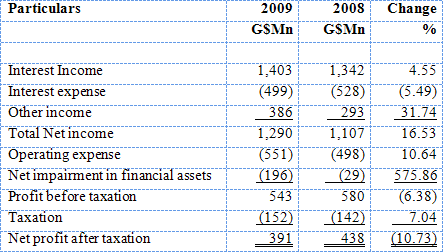

It has not been a good year for the banking arm of the group. While Republic Bank and Demerara Bank with similar year-ends have been reporting record profits, and with the Guyana Bank for Trade and Industry likely to follow suit, Citizens has seen its profit decline during the year from $438 million to $391 million, or by 11%. Contributing to this decline is an impairment provision of $170 million for investments in Stanford International Bank and Clico Trinidad Limited, the region’s two financial catastrophes for 2009.

Because of the difference in the governance arrangements referred to above, Citizens presents both a Chairman’s and a CEO’s report, the latter offering details and insights on some operational issues of relevance not only to members, but to depositors and the wider public who see strength in a financial institution being reflected in numbers and profitability.

Interest income increased by 5% and other income by 31% while operating expenses increased by 11%. Net customers’ deposits had a small decrease during the year with increases in savings deposits of 24% and demand deposits of 11% while the usually high-value term deposits declined sharply by 32%.

Share price

In 337 sessions since the Guyana Stock Exchange began trading in 2003, shares in Citizens have only traded on 9 occasions, 4 of which were in the last year. Given so few trades the price at which shares would change hands in usually limited volumes is not an indicator of what other transactions may fetch. The records of the Stock Exchange show a trade in the shares in Citizens in December 2009 at a price of $45 up from $18 in June 2009.

Next week we will look at the increasing abuse of the Contingency Fund as part of the deteriorating financial management of the public purse.