Statutory framework

Business Page was able to access the annual reports of the National Communications Network Inc (NCN) for the three years from 2004 to 2006 and for Guyana National Newspapers Limited (GNNL) for 2006. These reports were obtained from the Deeds Registry where they are required to be filed no later than August 11 following the close of the year. I also did a search in the parliamentary library and was assured that there were no later filings, thus confirming that these two government companies are grossly delinquent in meeting their statutory obligations. But their responsible Minister was similarly delinquent in laying the companies’ annual reports and audited accounts in the National Assembly. I will return to this shortly.

In addition to their obligations under the Companies Act, all government companies (defined in the Companies Act as 51% government shareholding) are subject to sections 48 and 49 of the Public Corporations Act. This requires government companies, no later than six months after the end of each calendar year, to submit to the Minister a report containing:

(a) an account of its transactions throughout the preceding calendar year in such detail as the Minister may direct;

(b) a statement of the accounts of the company audited in accordance with section 345.

The Minister then has up to September 30 to lay before the National Assembly a copy of the report together with a copy of the auditor’s report. This was not done for either NCN or GNNL.

The directors of NCN as shown in the last annual return filed for the year 2006 were Ms Jennifer Webster, (Minister) and Mr Desmond Noor Mohammed, Chartered Accountant and long-time supporter of the PPP. One of the signatories of the balance sheet is Mr Winston Brassington, Executive Director of NICIL.

The directors of GNNL as shown in their annual return for 2006 are Messrs Keith Burrowes, Hydar Ally, David De Groot, Tota Mangar, Patrick Dyal, Kwame McCoy and Colin Alfred.

Non-compliance

Despite the assertion in the audit reports on the financial statements of the two companies, both sets of financial statements are far, far away from compliance with International Financial Reporting Standards (IFRS), the basic requirements for the preparation of financial statements under the Companies Act.

Specifically, there is a complete lack of disclosures in the financial statements rendering analysis very difficult. The year 2005 was the first year of EU adoption of IFRS’s so by the end of 2006, there were substantial developments with several new standards coming into effect which would have required far more disclosure. But as we shall see the defects and deficiencies are even more basic.

NCN

NCN describes itself as a “State Owned and Operated Radio and Television Stations” with the parent company being National Industrial and Commercial Investments Limited. NCN went into operation on March 1, 2004 following the transfer to it of the assets and liabilities of the Guyana Broadcasting Corporation and the Guyana Television Company Limited. The balance sheet of NCN at December 31, 2004 shows a Share Capital (sic) of $35,000,000 and Reserves of $554,536,331, presumably the difference between the value of the assets transferred to it and the amounts of the liabilities which it was asked to assume. In ordinary language it means that the government invested more than half-a-billion dollars to get NCN started.

The liabilities it inherited included a Provision for Corporation, Property and Other Taxes of $18.834 million but by the end of 2006 that amount remained unpaid with no further charge for taxation, even though there is no evidence that NCN is exempted from taxation. Indeed, instead of making some kind of return to the country for taxpayers’ investment, the company was granted some $175 million over the period March 1, 2004 to December 31, 2006 in government subventions.

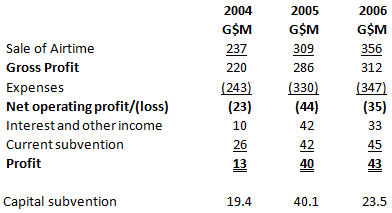

NCN Statement of Income

Source: Annual Accounts

Reservation

I express reservation on the discussion that follows with the comment that the financial statements – the audit report of which is signed by someone who is not qualified to do so under the Companies Act – contain some very elementary accounting errors. At best, therefore, these financial statements are unreliable and misleading and had there been the appropriate expertise available, they would almost certainly have been rejected at the Deeds Registry and in the National Assembly.

The first point to note is that if the Revenue Subvention is excluded from the Income Statement NCN made operating losses for the ten months of 2004 and in 2005 and 2006. What is even more surprising is that in 2006 – an elections year that often brings an advertising bonanza – NCN could actually make a loss, a feat that can only be achieved under unusual managerial expertise.

The Contingencies Fund

Indeed in 2006 the Minister of Finance had to bail the company out with a $20 million advance from the Contingencies Fund. What makes the matter so nearly pathetic is that while the person signing the audit report – Deodat Sharma – is also the same person who signs the Auditor General report, NCN is showing the Contingencies Fund advance as outstanding while the report on the Public Accounts does not even acknowledge an advance, let alone a debt!

And in payables, NCN shows a liability to the Ministry of Finance, a related party, if ever there was one. The financial statements do not, however, show any related parties, compounding the difficulty in any appreciation and analysis of the statements.

Then in the Statement of Changes in Equity, there are items like capital subvention for flood relief funds (2005) and negative amounts for amortisation, the corresponding entry for which could not be traced.

Strange too is the disclosure that PAYE payable at December 31, 2006 was the same as 2005, as are the provisions for Taxation ($18,834,104), Loan Creditor – Ministry of Finance ($2,332,646) and Other Creditors $110,930). Meanwhile NCN kept racking up other debts and at December 31, 2006 NCN owed unidentified persons some $80,743,424, close to two years worth of cost of sales, while showing accrued expenses as an asset!

Old debts

And on the other side of the balance sheet, Receivables at that date amounted to $205.5 million, including some $48 million of inactive receivables for the Guyana Broadcasting Corporation (GBC) and Linden which would hardly seem to be recoverable several years later and should certainly be written off. That still leaves some $157 million in other unpaid receivables at the end of 2006, an elections year. The question to be asked is how much did NCN bill the political parties for their elections advertisements and how much was paid by the end of the year?

Apart from the GBC and Linden receivable issue there were other concerns reflected in the audit opinion. The first relates to the failure by NCN to maintain an assets register for its more than $643 million worth of fixed assets and the failure to prepare and submit tax returns.

The range and nature of deficiencies identified in this analysis would do a disservice to a cake shop. NCN makes them look good. Just by way of information, one of the two persons signing the financial statements on behalf of the Board is Mr Winston Brassington of NICIL who was in the press recently attempting to teach the nation about accounting and the Companies Act.

To be continued